Balance vs EveryDollar

A premium price doesn't guarantee premium results. Why pay extra for an app that still makes you do all the work?

Unlock Your Financial Potential as a Couple

A relationship-centered design to get you on the same page for a better financial future

Communicate and Connect

Balance helps you chat about your finances in a helpful, friendly way by giving you one shared view of everything. You can make plans and celebrate your money wins as a team. It's not just an app—it's a tool to help you feel closer.

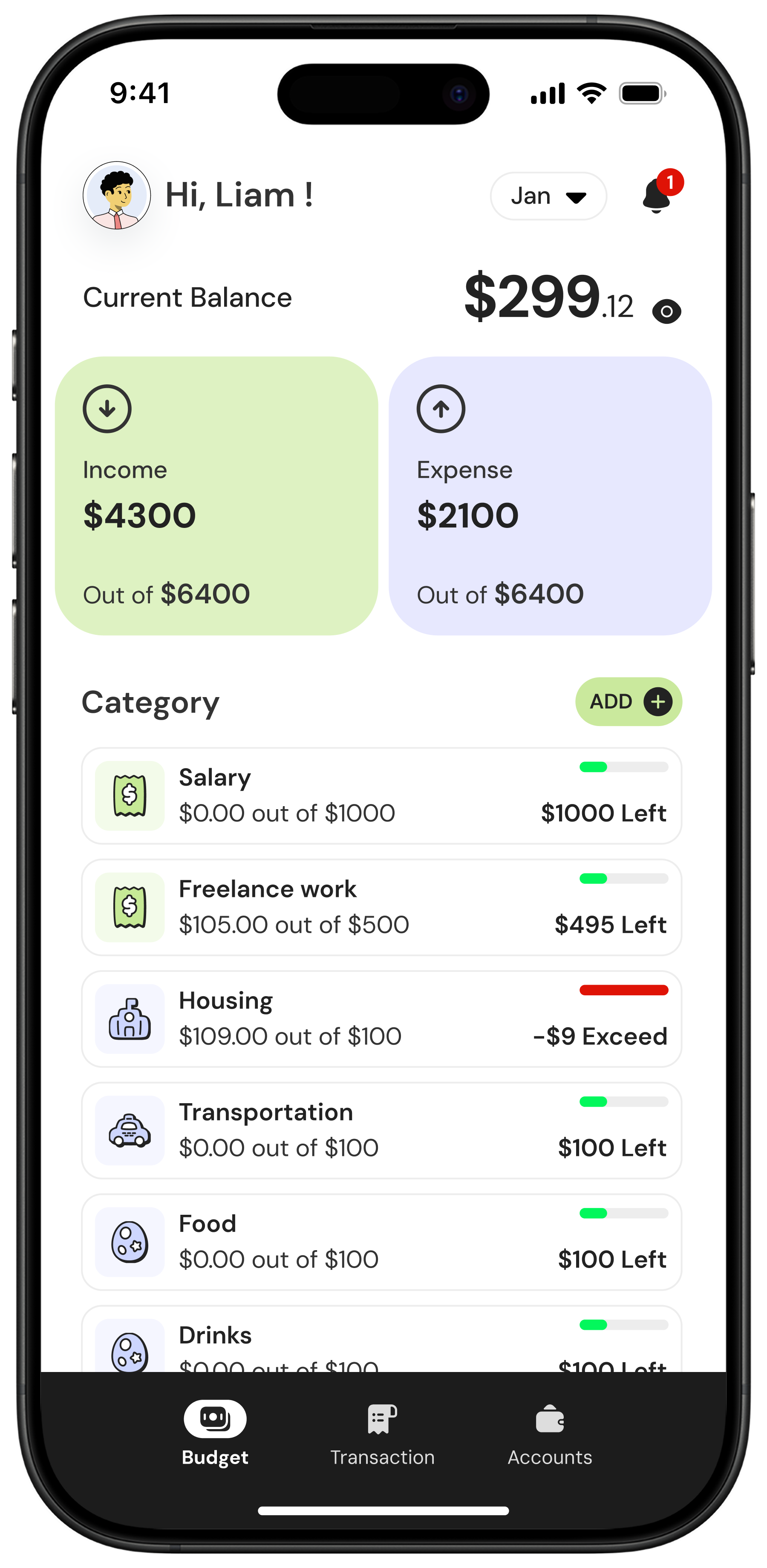

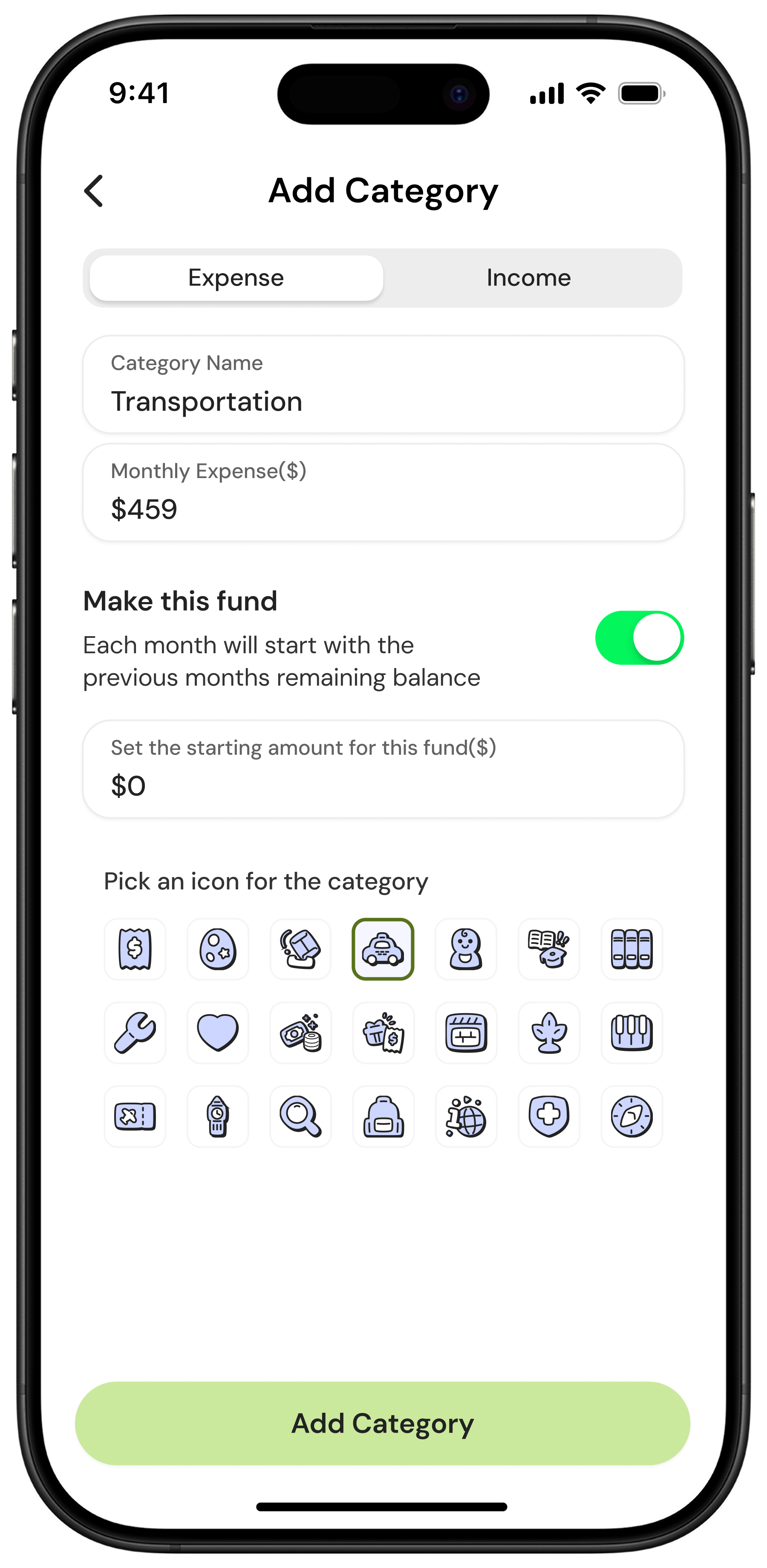

Easy to Use

You don't need to be a money expert to get started. Balance has a clean, simple design and even creates an automated budget for you based on best practices. It's great for both partners, especially if one of you isn't excited about budgeting. Our simple layout shows you what's most important so you can spend less time managing money and more time together.

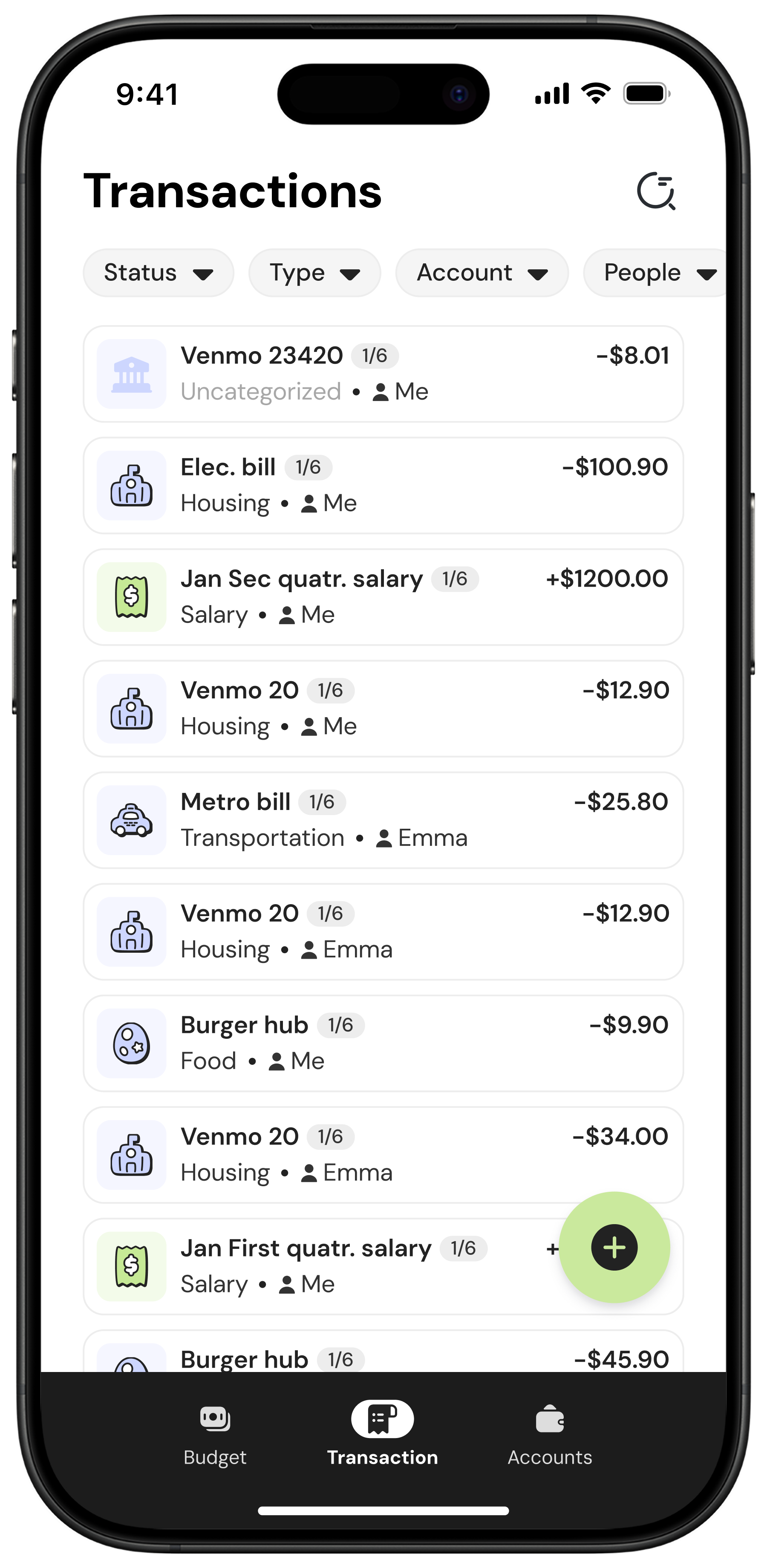

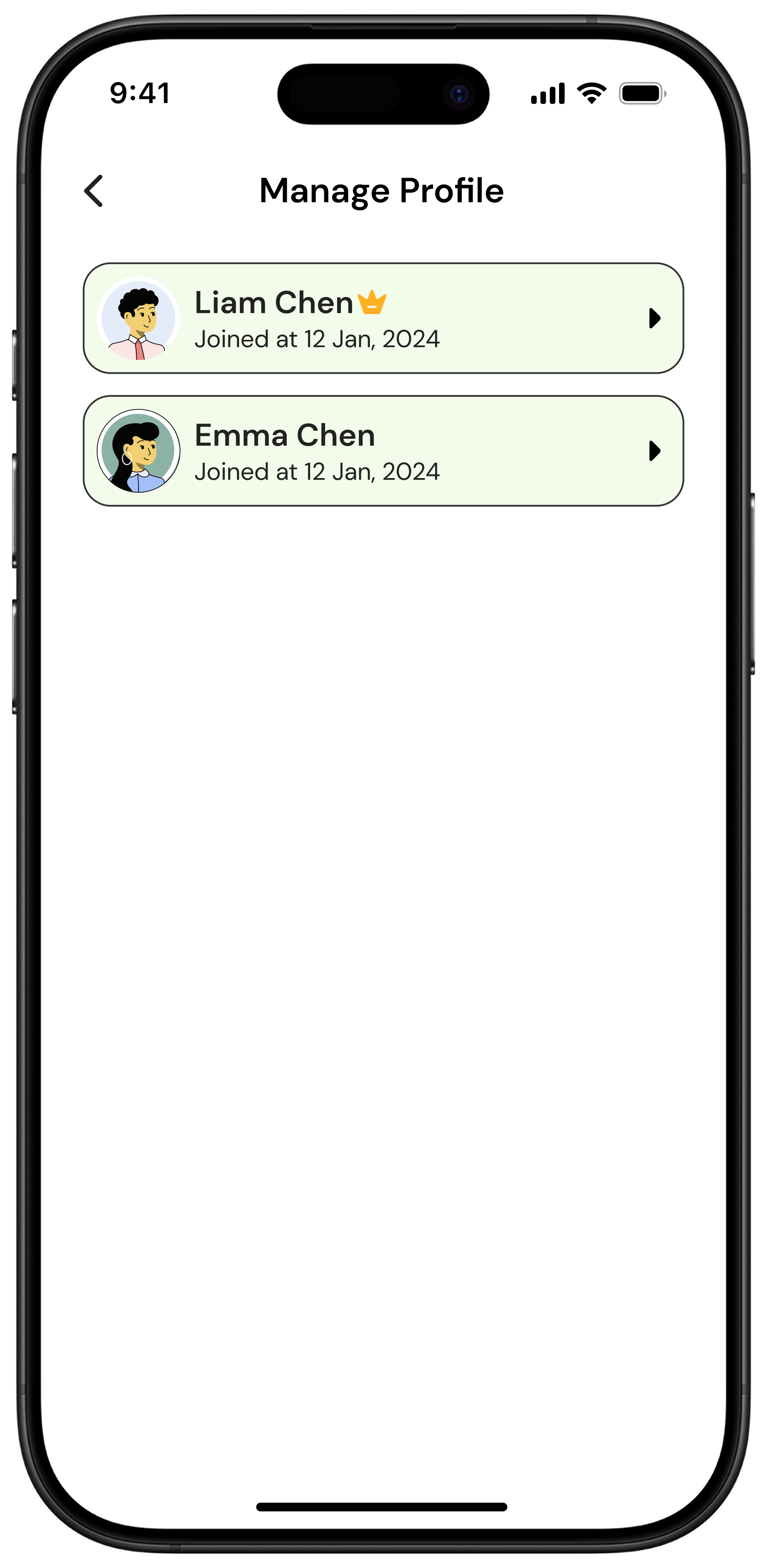

Build Trust

Stay updated with real-time balance and transaction notifications, ensuring you're always in sync. Being open and honest about money is a big part of a strong partnership. Balance helps you build trust by giving you a single place for all your finances. When you both see every transaction, there are no secrets. Our multi-profile support shows which partner added each transaction, making it easy to build a foundation of transparency and trust.

Secure Experience

Enjoy peace of mind with our secure platform, designed to protect your financial information.

Comparison

Balance vs EveryDollar

See how Balance stacks up against EveryDollar

Balance

- Free Version: Full featured, except automatic bank syncing

- Credit Card Management: Correctly categorizes payments as transfers

- Debt Management: Dedicated tools with clear path

- The Price Tag: Affordable with free trial

EveryDollar

- Free Version: Extremely limited; manual entry only

- Credit Card Management: Confusing system treats payments incorrectly

- Debt Management: Requires manual workarounds

- The Price Tag: Premium version required for bank syncing

Detailed Comparison

Balance vs EveryDollar

See how Balance stacks up against EveryDollar

| Feature | Balance | EveryDollar |

|---|---|---|

Free Version | Full featured, except for automatic bank syncing | Extremely limited; requires manual transaction entry |

Trial Version | Automatic bank syncing, shared goals, debt tracking, and real-time updates | Requires 100% manual entry; bank connection and syncing is a paid feature (EveryDollar Plus) |

Credit Card Management | Correctly categorizes payments as transfers, keeping your budget clean | Confusing system often treats payments as income or expenses |

Debt Management | Dedicated tools to help you pay down debt with a clear path | Debt handling is often confusing and requires manual workarounds |

The Price Tag | Affordable single price for both of you with a full featured free trial & premium bank syncing. | Premium version is pricey and required for bank syncing |

Why Couples Love Balance

"Balance was our first time using an app to budget. Already in the first month, we feel like we're in a better space financially."

You're not just managing money — you're building trust and confidence in your future, together.

Ready to Strengthen Your Financial Bond?

Stop manually tracking every dollar. Balance gives you a simpler way to budget Balance for less than half the price—just $5.99.

Get Started Free →